What Credit Score Do You Need to House Hack?

For the best mortgage rates, you’ll generally need a credit score of at least 720 to house hack. There are mortgage options available at lower credit scores, but they’ll most often come with higher interest rates and down payments since a lower credit score suggests you’re a greater gamble to lenders.

For example, it will often be very hard to qualify for the best mortgage programs with a score below 620. And you typically won’t see any additional benefits once your score is above 740.

In this blog post, we’ll discuss the factors that determine your credit score and some tips for boosting it so you can get the best mortgage terms.

We’ll also look at a few other factors that might affect your ability to get the mortgage you want.

How to Boost Your Credit Score for House Hacking

Your credit score is integral to your house hack. It determines what mortgage interest rates you qualify for. However, you’re not out of options entirely if you have a bad credit history.

You just need to take a few extra steps.

The first step in creating a plan to improve your credit score is to understand the factors that determine your score in the first place.

Credit Score Factors

Your score simply comes down to a calculation of several easy-to-grasp factors:

- Your payment history

- The amount of debt you have vs. the amount of debt you have available to you

- The length of your credit history

- The variety of credit types you have

- New credit inquiries

You can quickly and easily get a report on where you stand with these individual factors so you can plan for your future goals by consulting one of the three biggest credit reporting agencies in the United States: TransUnion, Equifax, and Experian.

If you’re suffering in one or more areas and your credit score is subpar, feat not! There are plenty of ways to boost it.

Tips for Boosting Credit (Each Factor)

Your credit score is a living, breathing thing. It can change. And it changes with each individual factor:

- Payment History – This is the most important factor in your credit score. Not making payments on time hurts your credit score immensely. If you have late payments, ask the reporting agency if you can get them removed from your credit report. Create a plan that will help you make timely payments from this point on.

- Amount of Debt vs. What’s Available to You – This is often called your “utilization rate.” The higher your debt load, the higher your utilization rate. If you’re constantly maxing our your debt load, this will generally hurt your score. You can improve your credit score by lowering your account balances.

- Length of Your Credit History – If you have a long history of making on-time payments, you’ll have a better score than if you are just starting out with credit. This is one that you can’t do much about, since you have to let time pass. But be careful opening up new debt, as this can greatly lower your average account age.

- Types of Credit – Having a mix of different types of credit, such as a mortgage, a car loan, and a credit card, can improve your score. This is a relatively small factor, so don’t bend over backwards trying to diversify your debt load too much.

- New Credit Inquiries – When you try to take out new debt, lenders will run your credit. These “hard inquiries” affect your credit score negatively. Try to not have too many outside checks. Hard inquiries typically drop off of your credit report within two years, and they usually stop affecting your score after one year.

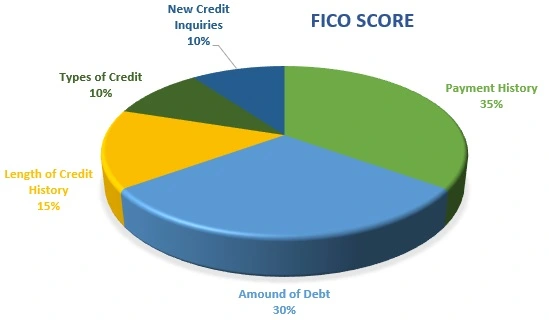

According to Investopedia, over “90% of the top lenders use FICO credit scores” . FICO scores are a specific means of weighing credit score factors based on the following percentages:

As you can see, you should definitely focus on the first three factors a lot more closely than the last two.

But every effort helps!

Other Factors that Might Affect Your Ability to Get a Mortgage

As integral as your credit score is to getting a mortgage for house hacking, it’s not the only factor that might affect your ability to get a mortgage.

Be sure to talk with a mortgage broker to determine where you stand, what options are available to you, and what you might want to improve upon before seeking a mortgage.

Nevertheless, here are some of the biggest factors besides your credit score that you need to consider.

Debt-to-Income Ratio

Your debt-to-income ratio (DTI) is the percentage of your monthly income that goes towards debts. To calculate your DTI, add up all of your monthly debts and divide them by your gross monthly income.

This number is important because lenders use it to determine how much of a lending risk you are. A higher DTI means you’re more likely to default on your loan, which is why lenders will be more hesitant to give you a loan until the ratio shifts.

Often, the best mortgage loan programs won’t lend to you if your DTI would be higher than 45 percent.

However, some will make exceptions, so ask a lender to make sure your DTI is low enough for the best terms.

Recent Loans

If you’ve taken out any loans within the past year or two, that could also affect your ability to get a mortgage.

Lenders want to see that you’re able to responsibly handle debt and that you’re not taking on too much at once.

Be especially careful when applying for new credit within a few months of asking for a mortgage. Very recent hard inquiries will be a red flag to lenders.

The Property Itself

The property you’re looking to buy will also affect your ability to get a mortgage.

Lenders will typically need to appraise the property to make sure it’s worth the amount you’re looking to borrow.

If the property is in a state of disrepair, it might be difficult to get a loan for it. Many loan programs only lend on “habitable” properties, though some allow you to build in a rehab budget, like the FHA 203(k) program.

And properties with more than 4 units typically only qualify for commercial financing (with worse terms than the low-down payment options available to a house hacker buying a single family or duplex).

Simply put, the property itself matters!

Keeping an Eye on Your Credit Score

Your credit score is the number that creditors use to determine your creditworthiness. It can impact everything from getting a mortgage, to qualifying for a car loan.

To ensure a stable financial future, keep a close eye on your score and make a plan to target any weak points.

This is especially important if you want to qualify for a mortgage to house hack.

Before you start house hacking, look at your credit report closely. Make sure there aren’t errors and get any corrected ASAP.

And if your score is lacking, figure out which factors need to be targeted to improve the overall score.

Knowledge is power.

Once you understand the bigger picture of your credit score, you can improve it or ensure that your score stays high.

FAQs

What credit score do you need to house hack?

You’ll likely need a minimum score of 620 or above to qualify for most loan programs. but for the best terms you’ll need a score over 720. However, this number could be higher or lower depending on the specific program.

What is the best way to improve my credit score?

There are many ways to improve your credit score. One way is to make sure there are no errors on your credit report. Another way is to focus on each of the individual factors that affect your score, like lowering your utilization rate or consistently making payments on time.

What if I don’t have a 620 credit score?

If you don’t have a 620 credit score, you might still be able to house hack with a different loan program. For example, the FHA loan program allows for lower credit scores. However, you’ll likely need a higher down payment.

What other factors affect my ability to get a mortgage?

Your debt-to-income ratio, any recent loans you’ve taken out, and the property itself can all affect your ability to get a mortgage. Make sure you understand all of these factors before applying for a loan.

This website, and any communication stemming from it, should not be taken as financial or legal advice for your specific situation. Consult directly with a licensed financial professional should you need investment advice and consult directly with a licensed attorney directly should you need legal advice. Assume all links are affiliate links. I am an Amazon affiliate.