Ah, the FICO score.

That magical three-digit number that’s supposed to summarize your entire financial history into a neat little package.

But what exactly is a FICO score?

In short, it’s a credit score. But not just any credit score – it’s the credit score that lenders use to decide whether or not to give you a loan.

If you’re looking to get a home loan so you can start house hacking, your FICO score will be one of the deciding factors.

So how is this number calculated? And what are the factors that go into it?

FICO Score Factors

Fortunately, the calculation isn’t exactly a closely guarded secret.

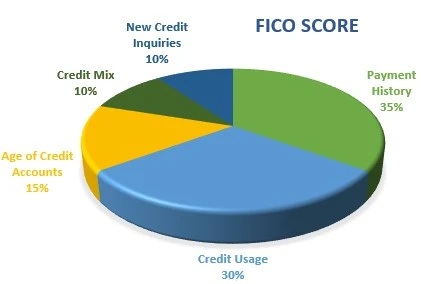

Your FICO score takes into account your payment history, your credit utilization, the age of your credit accounts, your credit mix, and any new credit inquiries.

Let’s review each of these factors in more detail:

Payment History

Payment history is the biggest factor that goes into your FICO score.

It’s important to make sure you’re always making on-time payments.

If you have a history of late payments, your FICO score will suffer as a result. On the other hand, if you have a good payment history, your FICO score will be boosted.

Simply put, if you’re looking to boost your FICO score quickly, the first step is to make sure you’re paying your bills on time.

Amounts Owed (Credit Usage)

The next factor is your credit usage.

Your credit usage (or “utilization rate”) is the amount of debt you have relative to your credit limits.

For example, if you have a credit card with a $1000 limit and a $500 balance, your credit utilization would be 50%.

The higher your credit utilization, the lower your FICO score will be. This is because high credit utilization is a potential indicator of financial stress, and lenders are reluctant to lend to people who are already are maxing out their debts.

Age of Credit Accounts

The next factor is the average age of your credit accounts.

Your FICO score will benefit the longer you’ve been using credit.

Lenders like to see that you’ve had plenty of history with using and paying back debt.

The longer a credit line stays open, the better.

So if you’re looking to improve your FICO score, one of the best things you can do is keep your oldest credit card(s) open and active.

That way, you’ll have a longer credit history, and a better average age of accounts.

Credit Mix

Another major factor that goes into calculating your FICO score is your “credit mix.”

This refers to the different types of credit accounts you have, such as credit cards, mortgages, auto loans, etc.

Someone who has both a mortgage and a credit card will benefit from this factor more than someone who just has a credit card.

So, if you’re looking to improve your FICO score, try diversifying your credit mix. It could help you get approved for that loan you’ve been wanting.

That said, this is a relatively small factor compared to the others mentioned above.

New Credit Inquiries

The next factor is whether you’ve made recent credit inquiries.

When you apply for a new credit card, the lender will typically perform a hard inquiry on your credit report.

This type of inquiry can lower your FICO score by a few points.

Thankfully, the effect of a hard inquiry on your FICO score will typically disappear after a year or so.

In short, applying for a new credit card can have a small negative impact on your FICO score. However, as long as you manage your credit responsibly, your FICO score should quickly rebound.

Like credit mix, this is also a smaller factor when compared to the rest.

FICO Score: The Good, The Bad, and The Ugly

Your credit score will fall into a range between 300 and 850.

Anything above 650 is considered Good.

Anything below 550 is considered Poor. That means it’s unlikely you’ll get approved for loans without a cosigner or extremely high interest rates.

On the opposite extreme, if your score is between 750 and 850, that means you have Excellent credit. This is the range you’ll want to be in for the best loans with the best interest rates.

Importance of a Credit Score When Buying A House

Lenders use your credit score to determine how likely you are to repay a loan.

If you have a high score, getting approved for a loan and receiving lower interest rates is easier.

On the other hand, a low score means you risk higher interest rates and even being denied a loan altogether.

In addition, your credit score can affect your down payment options.

For example, if you have a FICO score of 580 or above, you may only need a 3.5% down payment on an FHA loan. However, if your score is below 580, you’ll need at least 10% down.

As a general rule, if you’re around a 740 score or higher, you should be able to get the best possible terms on loans.

Tips for Improving Your FICO Score

There are a few simple things you can do to improve your FICO score.

First, and most importantly, make sure you always pay your bills on time! This includes credit card bills, utility bills, and any other recurring payments.

Second, keep your balances low. If you have multiple credit cards, try to keep the balances on all of them below 30% of their credit limit, if not lower.

Finally, don’t open too many new accounts at once. Applying for multiple new lines of credit can lower your FICO score, so it’s best to space out your applications.

This website, and any communication stemming from it, should not be taken as financial or legal advice for your specific situation. Consult directly with a licensed financial professional should you need investment advice and consult directly with a licensed attorney directly should you need legal advice. Assume all links are affiliate links. I am an Amazon affiliate.