Why Credit is Important for Real Estate

A credit score establishes your trustworthiness with lenders based on your history of meeting debt payments. This helps them determine whether they should lend you money to buy real estate.

Investing in real estate is one of the biggest steps any person can take to build a firm financial foundation.

But, to do that, you’ll probably need to take out a loan.

Here’s why managing your credit is so important for real estate investing and some of the many financing options out there.

Maximizing Your Financing Options

Real estate offers a host of great financing options.

The better your credit score, the more of these options you’ll be able to take advantage of at the best terms.

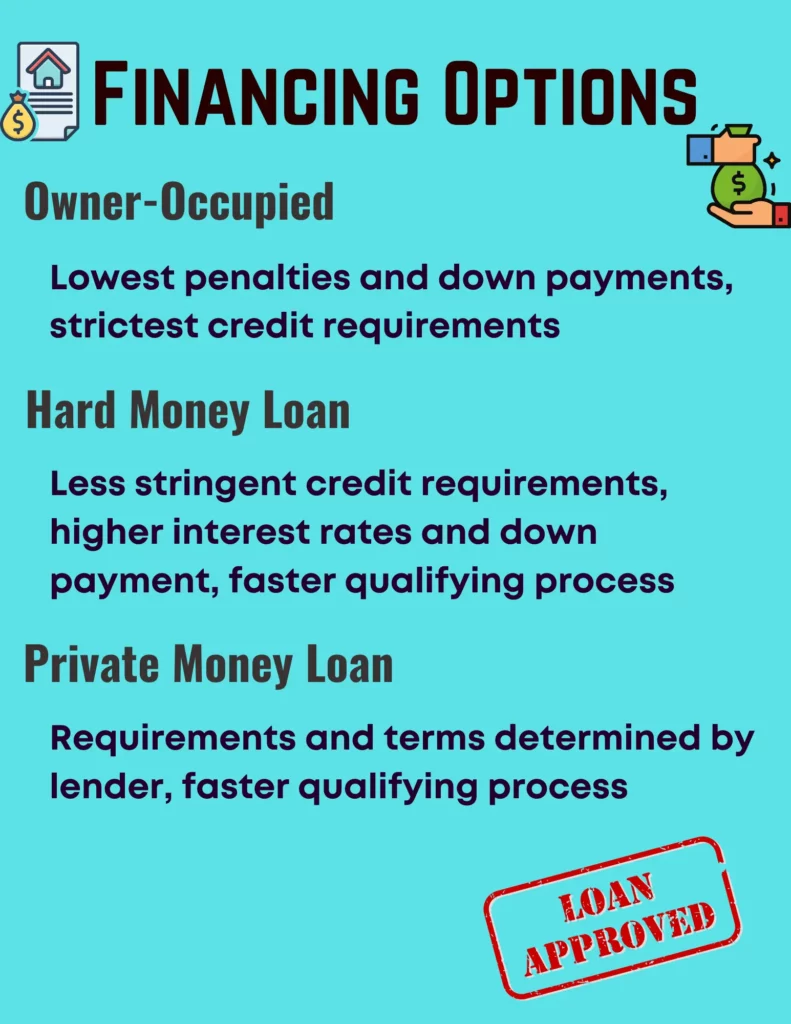

Owner-Occupied Financing

‘Owner-Occupied’ financing is used to purchase a property with the intention of living in it.

This type of financing usually comes with better terms than investment loans.

In most cases, they have lower interest rates, fees, penalties, and down payments.

Because of these benefits, owner-occupied loans are tempting to home buyers, but they also come with the strictest requirements, like higher credit score requirements and having to live in the property for a year.

Here are some examples:

-Conventional

A conventional loan is the most common type of mortgage. They are either “conforming” or “nonconforming” to the guidelines set by Fannie Mae and Freddie Mac, which ends up buying many conventional mortgages.

They typically require a credit score of 620 or above and a debt-to-income ratio (DTI) no higher than 45%.

In most cases, the home buyer must make a minimum down payment of 5%, though that will mean that the homeowner has to pay private mortgage insurance (PMI) until he or she has 20% equity in the property.

-FHA Loan

An FHA loan is backed by the Federal Housing Administration. It allows a DTI above 50% in some cases and a down payment of 3.5% if the buyer has a credit score of at least 580.

The credit score requirement for an FHA loan is between 500 and 620, but at the 500-579 range, the down payment requirement rises to 10%.

However, FHA loans do come with loan limits depending on the area and number of units on the property.

An ‘FHA 203k’ loan is one that covers the rehabilitation costs of an FHA property.

Check out our article on using FHA 203k loans here!

-VA Loan

A VA loan is backed by the Department of Veterans Affairs requiring no minimum credit score or down payment but is only available to certain veterans and active-duty service members.

That’s right: VA loans don’t require a down payment if you qualify.

To obtain a VA loan, a home buyer must first get a “Certificate of Eligibility” (COE).

-USDA Loan

A USDA loan is backed by the United States Department of Agriculture and allows home buyers to borrow 100% of the appraised property value with no down payment and a lower interest rate, but is limited to rural properties.

Lenders typically require a credit score of at least 640 for USDA loans.

Hard Money Loans

A ‘Hard Money Loan’ is insured by the property, or by other assets, as collateral so that if the investment doesn’t yield profit, the lender will still make money.

Utilizing these loans is a much speedier process with less red tape since the credit score and DTI requirements are determined by lenders without outside regulation.

Hard money loans aren’t always provided by banks. More often, they are provided by individuals or companies specializing in hard money loans.

They are more suitable for those with a tighter timeline to close on a property or as a last resort for those who don’t meet the stringent requirements for Owner-Occupied loans.

However, this option also comes with higher interest rates, steep fees, and a higher down payment requirement.

Rates can often eclipse the double digits, and you might have to pay a point or two (or more!) in fees up front.

But they can give you much-needed liquidity for a property that might otherwise be ineligible for other types of financing.

Private Money Loans

‘Private Money Loans’ are short-term loans used to purchase or refinance real estate which hold fewer regulations than owner-occupied loans and have requirements determined solely by the lender.

These loans aren’t offered by banks, but by private lenders and, like hard money loans, they are a quick solution and can be obtained by individuals with poor credit and lower income since private lenders come up with their own requirements.

The terms for private money loans are entirely flexible.

To get a private money loan, you’ll likely have to do some serious networking to find people willing to lend to you.

But, once you do, you’ll have more flexibility in taking down real estate deals.

Boosting Your Credit Score for Real Estate

Credit scores are integral to the real estate game, but don’t think you’re out of luck if your credit score doesn’t meet the lowest requirements for the most attractive financing options.

Here are some tips and tricks to help you boost your credit score:

- If you have one or two late payments but have a history of making payments on time, you may be able to get the late payments waived.

- If you suspect something hurting your credit score is a clerical error, have documentation handy and contact the credit reporting agency showing the error.

- You might be able to arrange with your landlord to get rent payments reported to a credit bureau.

- If you have serious problems with your credit, a credit repair service can help you navigate them.

Conclusion – Credit & Real Estate

Credit ratings include all of the information you’ll need to obtain the best financing options.

After all, it’s far less likely that a lender will lend to you if you’ve failed to pay back other lenders in the past.

Make sure to do plenty of research on the options available to you to boost your credit score.

And remember you have many options when it comes to financing a property.

This website, and any communication stemming from it, should not be taken as financial or legal advice for your specific situation. Consult directly with a licensed financial professional should you need investment advice and consult directly with a licensed attorney directly should you need legal advice. Assume all links are affiliate links. I am an Amazon affiliate.