How to Analyze a House Hack

The key to analyzing a house hack is to develop a solid understanding of your rental market and keep your projections reasonable.

For a house hack, run the numbers as though you were to move out of the property and keep it as a “normal” rental. You also want to make sure that you’re accounting for actual and potential expenses.

Here are some tips for analyzing a house hack.

Know Your Market

Don’t jump the gun and purchase just any property that seems like a good deal because of fear of missing out.

Devote enough time to both in-person and online research that you know you’re getting a good deal.

You want to be sure you have a high chance of executing a successful house hack.

- Look Around. Once you’ve found an area that you’re interested in, make sure that you become very familiar with it. Drive around and take note of the presence of single-family vs. multi-family housing as well as any potential fixer-uppers. Get a feel for what streets or neighborhoods might be better or worse than others. After all, for a house hack, you’re going to be living there, so you definitely have to be comfortable with the area.

- Don’t Skimp on Research. You’ll also want to do extensive research on market values in the area. Become an expert. When you do, you’ll know when to jump on a deal and when to hold out for a better one.

- Consider hiring a real estate agent. A good agent will be equipped to help you identify good deals based on your search criteria. Sometimes they may also be able to help you snag an off-market deal. And, as a buyer, you’ll rarely have to come out of pocket to pay a buyer’s agent.

- Get familiar with rental prices. Make sure that you’re also familiar with rental prices in the area. Get a sense of how much you can charge for rent. Making reasonable rental projections before you buy the deal will help you avoid future stress.

- Understand the demand for rentals in your area. Consider factors that may contribute to the demand for temporary or long-term rentals. If you’re planning to buy a single-family home and rent out extra bedrooms, you’ll want to make sure that there is sufficient demand for what you’re offering. For example, the presence of college students is often a good indicator that there will be interest for smaller units. Or if “traditional” rentals are extremely expensive in an area, alternative options like renting a bedroom might be more attractive than in other markets.

Running the Numbers on a House Hack

As soon as you identify a possible deal, run the numbers to figure out if it’s actually worth it. Calculate whether that rental income will help offset living expenses or if the deal is simply too expensive.

Thankfully, the math is straightforward!

Income

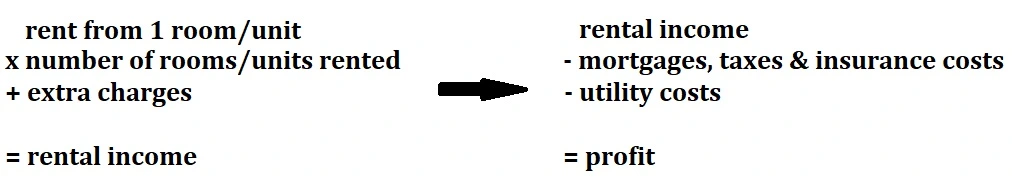

Once you have an idea of how much you can reasonably charge for your rooms or units, calculate your monthly income relative to your expenses.

In addition to factoring in rental income, you’ll want to consider any potential extra sources of income. For example, you might charge your tenants for parking spaces, laundry facilities, or other amenities.

If you’re renting out rooms in a single-family home, make sure to crunch the numbers as if you were renting out each bedroom individually.

Conversely, run the numbers as if you were renting out the entire home as one as well. Make sure that your property will still be financially advantageous to you if you decide to move out and rent it “normally.”

That way, if you need to rent out the entire unit, you’ll still be making money.

Expenses

In addition to calculating your monthly mortgage payments, make sure to factor in extra expenses like taxes, insurances, capital expenditures, utilities, homeowners association (HOA) fees, and potential vacancy.

You may also need to account for extra costs associated with managing your properties. Landscaping fees and other maintenance costs can add up and you want to be prepared. Your utility expenses are also likely to increase if you are renting out your space to multiple tenants.

You should keep some cash in reserves for unexpected expenses like vacancies and damages. It’s recommended that you have at least three months of your property’s rental cost in reserves, or whatever amount makes you comfortable.

You never know when the property will go vacant and you’ll need to cover expenses with your savings.

Your Net Savings by House Hacking

The main advantage to house hacking is that it will allow you to build equity in your home while saving money as your rental income helps cover your mortgage costs.

Any rental income that you make can go right toward out-of-pocket expenses like your mortgage, HOA fees, and utilities. At the same time, the principal paydown should further reduce your net housing costs.

Subtract your rental income and principal paydown from your out-of-pocket expenses. Your net costs should be significantly lower than if you were to rent a comparable apartment or a smaller property.

What’s the Ideal House Hack?

The ideal house hack covers all of your housing costs and then some. But these deals are rare.

Thankfully, you don’t need to land a deal like this to have a successful house hack.

In many cases, you can at least cover your mortgage, so you only have to cover a fraction of your typical housing expenses each month.

You may have to get creative to find ways to boost income on the property. But there are lots of potential deals out there that can dramatically reduce your net housing costs.

That said, not only should the ideal house hack save you money and reduce your net housing costs, but it should ideally also function as a standalone rental if you were to move out of the property.

This is to ensure freedom and adaptability.

You’d hate to be burdened by a house hack deal when you decide that you want to move. It should at least break even from a cash flow perspective so that you don’t have to come out of pocket to keep owning it.

Regardless, tread carefully and don’t twist the numbers! They are your first line of defense against getting stuck with a bad deal.

Analyzing a House Hack

The most important step in analyzing a house hack is to do your research. Do so both online and in-person until you are knowledgeable (and comfortable!) with an area.

Don’t rush into anything.

Become an expert on your market.

Fully understand your potential rental income and landlord expenses. This allows you to predict if your house hack will be successful.

And when you do land that great house hack deal, you’ll be happy you did your due diligence before hand.

FAQs

What is house hacking?

House hacking refers to the process of renting out extra space in your primary residence.

That means purchasing a single-family home and renting out the extra bedrooms. You might also purchase a multi-family property and rent out the extra units.

The aim is to make enough from rental income to offset your housing expenses.

How should I finance my house hack?

House hackers have the ability to take advantage of owner-occupied financing. Conventional mortgages for primary residences and FHA loans often come with lower interest rates and down payments.

One common stipulation is that you must typically occupy the home for the first year before you move out.

Is house hacking worth It?

House hacking can be a wonderful way to offset your cost of living, especially in an expensive market.

Although you may be sacrificing a bit of privacy, and it does require some extra work to find and manage tenants, the financial advantages make it well worth it for a variety of beginner and veteran real estate investors alike.

This website, and any communication stemming from it, should not be taken as financial or legal advice for your specific situation. Consult directly with a licensed financial professional should you need investment advice and consult directly with a licensed attorney directly should you need legal advice. Assume all links are affiliate links. I am an Amazon affiliate.