The first step to a successful house hack is running the numbers. You want to for all possible savings and every potential expense.

Running the numbers can be intimidating, but you don’t have to be a math whiz to do it. It’s a matter of running a few simple calculations and making reasonable assumptions.

This articles provides an overview of the important numbers to consider in your house hacking plan so you can protect yourself before you make a purchase.

Offsetting Your Housing Costs

Although the numbers can get complicated, the main goal of a successful house hack is simply to offset your housing costs as much as possible.

A properly executed house hack allows a homeowner to live for free, or close to it.

Here are some of the items to consider:

Consider All Potential Income and Expenses

Ideally, your rental income will cover a significant chunk of your mortgage as you continue to build equity in your home.

In addition to your monthly mortgage payments, you’ll want to consider any extra expenses. These include:

- Taxes

- Insurance

- Capital expenditures & repairs

- Utilities

- Homeowners association fees

- Vacancy reserves

When it comes to calculating your expenses, you have to factor in saving for reserves (for capital expenditures and vacancy in particular).

When calculating your income, be sure to consider any additional sources besides rent. For example, you may charge tenants for a garage or parking space, laundry facilities, and other amenities.

An Example of a Successful House Hack

To illustrate how a successful house hack can significantly reduce your net housing costs, here’s a house hack that I did to start my real estate investing career: a condo house hack in Chicago.

I had three options for housing: (1) purchase a one-bedroom/one-bathroom condo, (2) rent a one-bedroom/one-bathroom condo, or (3) purchase a two-bedroom/two-bathroom condo and rent out the extra bedroom and bathroom.

Here’s what the numbers looked like for each option:

Two Bed/Two Bath House Hack

– $700 Mortgage

– $255 Taxes&Ins.

– $194 Condo Dues

– $150 Utilities

+ $800 Rent

= $469 Out-of-Pocket

+$170 Principal Paydown

= $299 Net Cost

One Bed/One Bath Buy

– $550 Mortgage

– $175 Taxes&Ins.

– $180 Condo Dues

– $150 Utilities

= $1,055 Out-of-Pocket

+$133 Principal Paydown

= $922 Net Cost

One Bed/One Bath Rent

– $1,000 Rent

– $100 Utilities

= $1,100 Out-of-Pocket

=$1,100 Net Cost

As you can see, the out-of-pocket cost of housing was far lower with the house hack option. And once I considered principal paydown as well, the net cost of the two-bedroom/two-bathroom house hack was significantly lower than the others.

Simply put, I got to live in a nice property for a very low net cost.

Accelerating Principal Paydown

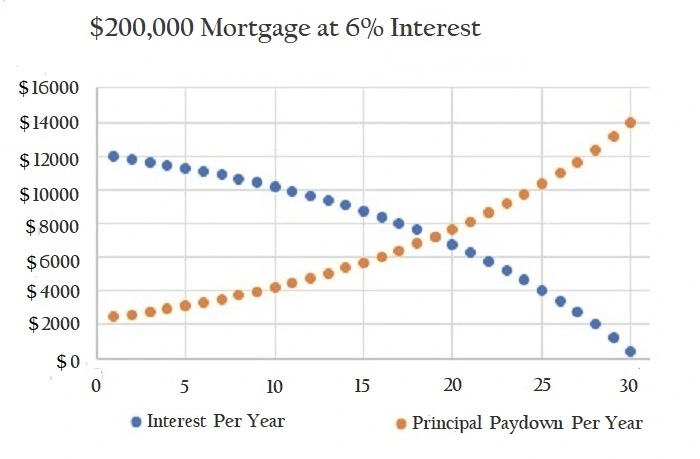

As shown in the example above, a huge benefit to house hacking is that you can continue to pay down the principal on your mortgage while your rental income helps cover your out of pocket costs.

With an amortized loan, the portion of your monthly payments that goes toward paying down the principal increases each month. In short, as the remaining principal shrinks, the interest payments also get smaller.

Consequently, you’ll end up increasing your net savings over time while paying down the loan at an accelerated rate:

Tax Advantages of House Hacking

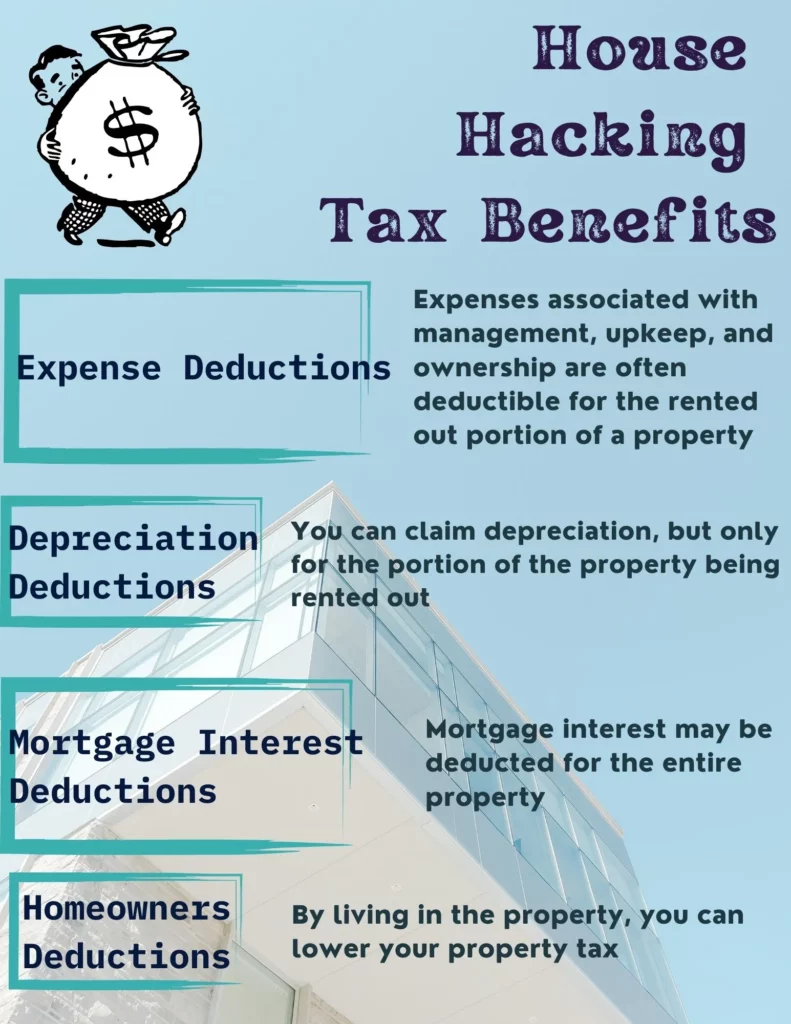

Although income earned from house hacking is generally taxable, there are plenty of potential deductions that house hackers can claim in order to reduce that taxable income.

Expense Deductions

House hackers can typically only deduct expenses for the portion of the property that they’re renting out. Any expenses related to the portion of the property where you reside will generally not be deductible.

Expenses for the rented part of the property should be reported on your Schedule E tax form (Form 1040).

Some common expense deductions associated with house hacking include management costs, fees for contractors and inspectors, legal and accounting fees, utilities, property taxes, and any other expenses related to repairs and home office costs.

Definitely contact a tax professional to make sure you get all the deductions you’re eligible for.

Depreciation Deductions

While you cannot depreciate a property that is only used as your primary residence, you can often claim depreciation on the portion of the property that you’re house hacking.

However, since you can only claim depreciation on the portion of the property that is rented out, you’ll need to determine exactly how much is depreciable.

If your property has multiple distinguishable units, you can simply calculate the ratio of the units that you are renting versus those that you are occupying.

If you’re renting out extra bedrooms in a home with shared living spaces, you may want to use the square footage to determine what percentage of the property is occupied by your tenants.

Consider consulting a tax professional to make sure you properly claim depreciation, assuming it’s available to you.

Mortgage Interest Deduction

House hackers can also benefit from a mortgage interest deduction, which can be claimed for both the rented and personal portion of your property.

Keep in mind that the rental portion of your mortgage interest should be reported on your Schedule E tax form. The personal portion should be reported on your Schedule A tax form instead.

Again, ask a tax professional to make sure you do things properly on your tax return!

Homeowners Deductions

As long as you are living in the property, you may also be able to take advantage of a homeowners deduction offered by your local tax authority, which will directly lower your property tax bill.

The Numbers Behind House Hacking

It is essential that you do the math on a potential house hack before closing on a property.

At the end of the day, a successful house hack should significantly offset your housing costs and set you on the path to becoming a successful real estate investor.

Before you begin your house hack, take note of every projected expense and all potential rental income.

And consider hiring an accountant or a tax professional to make sure that you’re making the most of all tax advantages and claiming the full benefits of your house hack.

This website, and any communication stemming from it, should not be taken as financial or legal advice for your specific situation. Consult directly with a licensed financial professional should you need investment advice and consult directly with a licensed attorney directly should you need legal advice. Assume all links are affiliate links. I am an Amazon affiliate.