This is a guest article by Katie Conroy of advicemine.com.

Debt Management Tips for the Aspiring Home Owner

It’s not uncommon for individuals to have a type of debt, including a student loan, a personal loan, or a car finance loan. If you have any of these, the good news is you can create a debt repayment plan that ultimately benefits you and makes it even possible to own a home in the near future. While debt must be repaid, all debt is not the same.

For example, as described below, a mortgage is considered good debt, something to consider when you’re shopping for a home in Chicagoland where the median home sale price stands at over $370,000.

Some debt is considered good debt, and other types can be considered bad debt. Bad debt involves borrowing money for things that will not help you achieve financial gain, like your day-to-day expenses. Here are some ways you can manage debt more effectively if you want to own a home soon.

–Always Pay on Time

One of the things you must-do if you want to purchase a home is to improve your credit score. Your payments history counts for up to 35% of your credit score according to myFICO, making this a key factor in the calculation. So, it’s important to ensure you always pay your debts on time to improve your credit score.

Find the money and pay as soon as possible when you miss payments. This will make a difference, and the change is reflected in your credit report. The credit report tracks your payments if you’re 30 to 90 days late.

–Consolidate Your Loans

Having multiple debts means you will need to pay multiple fees and interest. Wells Fargo explains that debt consolidation brings all these loans into a single pool to create one debt, which offers lower interest and fees, so you can repay the loan much easier. This idea is easier to manage as you don’t need to think about different debts with different terms and rates. You only make a single repayment.

–Make Extra Payments

It’s ideal to make extra payments if you can afford it. Instead of paying the regular payments, you could add some amount on top to accelerate debt repayment. Through this solution, you’ll pay off the debt faster, and you also pay less interest, meaning you could get thousands of dollars in savings if you owe a large amount.

However, before committing extra payments for your debt, review the loan conditions, as some lenders charge for paying off debt early.

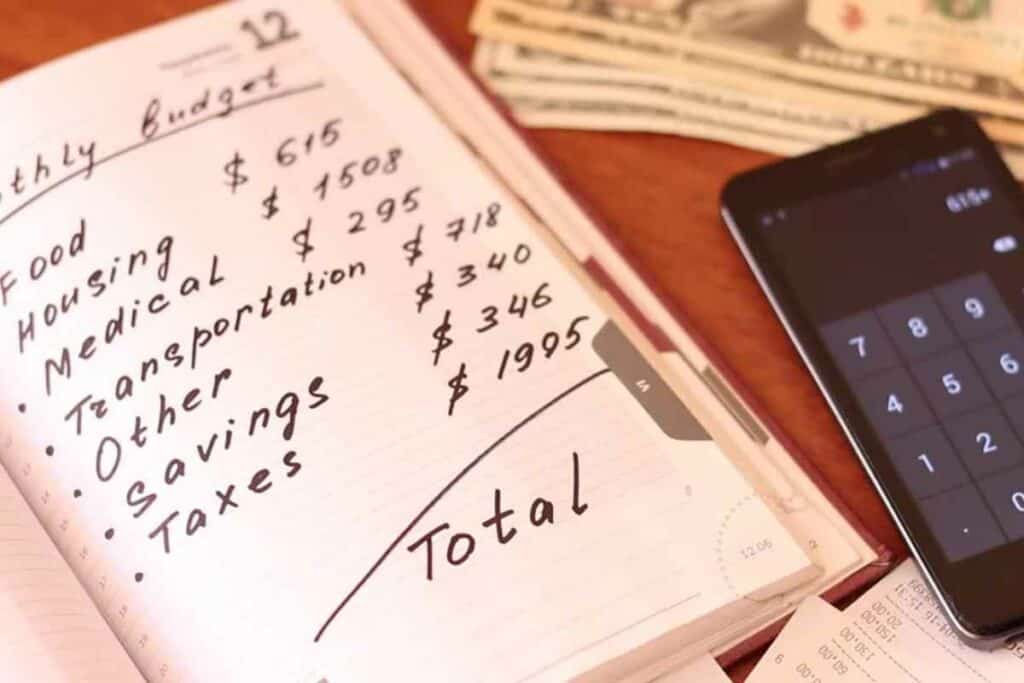

–Track Your Expenses

Developing a budget will help you monitor the amount you’re earning and how much you’re spending. It will help if you know the rate you’re spending and the things you spend the most on.

This means you’ll be more aware of how your income is allocated, so you can eliminate unnecessary costs, freeing up money that you can use to settle your debts.

–Don’t Take On More Debt

You should always work toward settling what you owe before you add new debt. Avoid unnecessary purchases, as these could lead you to apply for more loans. When you’re in debt, the target should be to minimize expenses and maximize debt repayment. Taking on more debt means you will not have enough to repay your monthly installments, which could impact your credit score.

When you settle your credit issues, you can then apply for a mortgage for your new home. Invest enough time in research before buying your new home. Familiarize yourself with the different mortgage rates for a VA or conventional mortgage. If you own a business, it can be helpful to organize it as a limited liability company (LLC) to prevent any financial issues with the business from affecting your home. Each state varies somewhat in their requirements as it pertains to forming a business, so be sure to learn how to start an LLC before proceeding.

Conclusion

You must prepare your credit score to ensure mortgage lenders can consider you a worthy borrower to buy a home. There are different options to boost your credit score, including paying debts on time, avoiding taking on more debt, and making extra payments towards your outstanding loans.

This website, and any communication stemming from it, should not be taken as financial or legal advice for your specific situation. Consult directly with a licensed financial professional should you need investment advice and consult directly with a licensed attorney directly should you need legal advice. Assume all links are affiliate links. I am an Amazon affiliate.